Give your feedback below or email audiofeedback@marketwatch.com.

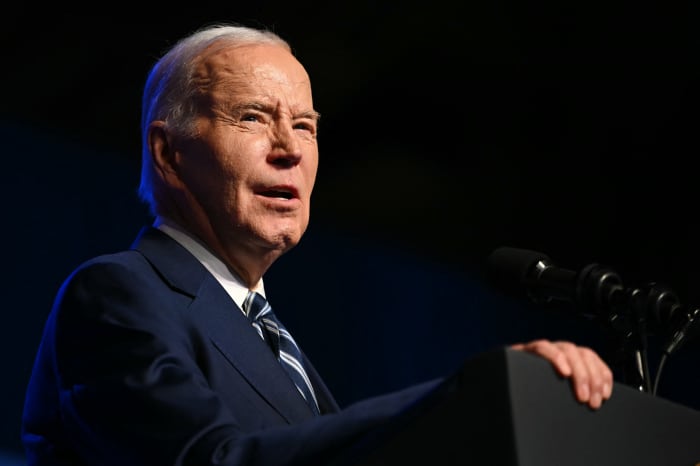

Joe Biden proposes hitting Donald Trump with a $1 billion tax bill

The president has proposed a tax on unrealized capital gains for people worth more than $100 million. Who do we know falls into that category?

Biden has released a clever campaign document disguised as a budget.

ANDREW CABALLERO-REYNOLDS/AFP via Getty Images

Give your feedback below or email audiofeedback@marketwatch.com.

That’s something they may come to regret, because it’s a campaign document for the presidential election. And as such, it’s pretty clever.

Among its features, buried in the fine print, is a big stick that Biden can be expected to use against Donald Trump in the fall.

That stick: a hefty 25% tax on unrealized capital gains for people worth more than $100 million.

Hmmm. Who do we know who is worth more than $100 million and likes to brag about paying no taxes?

During Trump’s first debate with Hillary Clinton in 2016, she brought up past tax disclosures that showed that in certain years, her opponent had effectively paid no federal taxes. Trump didn’t deny it. “That makes me smart,” he retorted. He didn’t offer a rebuttal when she said he might have paid taxes for a decade.

Even former Trump cheerleader Ann Coulter found that too obnoxious to bear.

The U.S. tax code is insane in many ways. (Biden’s budget, incidentally, would pile still more complications and convolutions onto a system that is already a monstrosity.) One of its features is that, despite what Bernie Sanders likes to imply, it does not treat millionaires and billionaires the same way.

People who earn more than $1 million a year are generally taxed very heavily. If you include state and maybe local taxes, the top rate for such earners may already be near 50% and could soon be much higher. Even people who earn a lot less but have at least $1 million in assets usually pay pretty hefty taxes.

It’s the billionaires whose tax bill resembles a love letter from the IRS. Billionaires along with those worth hundreds of millions of dollars, that is.

Those people don’t live on income. They live on assets. Taxes on assets range from low to nonexistent.

I know, I know — it’s an absolute shock that the donor class has bought themselves a tax code that benefits them at the expense of everyone else. Right?

It’s something to think about every time politicians argue about taxes for “high earners,” trying to equate those people with the super-rich. Most high earners are workers and are taxed heavily. Unless politicians start to go after untaxed assets, they are just playing you.

Which brings us to Biden’s fascinating campaign document wrapped in a federal budget. The key facts don’t even appear in the budget itself, but in a companion document titled “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals.” It comes from the U.S. Treasury, not the White House, and is nearly 300 pages long.

Page 83 is a doozy. “The proposal would impose a minimum tax of 25 percent on total income, generally inclusive of unrealized capital gains, for all taxpayers with wealth (that is, the difference obtained by subtracting liabilities from assets) greater than $100 million,” it says.

Objectively, this shouldn’t be a big deal. Workers have to pay a 24% tax rate once their taxable income for the year exceeds $95,000, or $190,000 for joint filers. Those rates rise as high as 37% once people clear about $600,000 a year. It hardly seems like the height of communism to levy a 25% tax on people worth more than $100 million.

But it will be greeted that way, because it touches the donor class. (When people criticize Congress, I like to remind them that we have the best Congress money can buy.) Cue the inevitable cries of “taxing wealth creators” and so on.

Apparently the rest of us aren’t wealth creators.

Biden’s proposal is an attempt to move the so-called Overton window on the issue of assets and wealth taxes. The Overton window refers to ideas that are considered within the realm of normal debate. Elizabeth Warren brought up wealth taxes during her failed 2020 presidential election campaign, but the proposals went down with the ship. Biden, or his team, wants to bring them back into the discussion.

We don’t know how much Donald Trump is worth, or how much that changes from year to year. Forbes says that figure is up about $4 billion this year, mainly due to Trump’s stake in Trump Media & Technology Group DJT, 5.16%, currently valued at around $4 billion. Based on the company’s financials, we can assume that’s nearly all profit.

At these levels, his Biden tax would be a cool $1 billion.

Taxes will not become law. Not anytime soon, and maybe never. But it will surely make for a lively punch line this fall.